How To Be A Millionaire in 5, 10, 20, 30 Years

- Mr Money TV

- Jul 21, 2023

- 3 min read

We all dream of financial independence, the freedom to pursue our passions, and the ability to provide for our families. Often times, we find ourselves Googling: "How to be a millionaire?" and the answers we get is vague. We might think that becoming a millionaire seem like a goal only attainable for a lucky few, especially if you’re only just starting out.

The truth is, with the right plan and diligent execution, you can join the ranks of self-made millionaires, regardless of whether your timeline is 5, 10, 20, or 30 years. Here is your cheat sheet and guide on how to become a millionaire within different timelines.

How To Be A Millionaire In 5 Years

Here’s how to read the above table:

In order to achieve your target of becoming a millionaire in 5 years, you will need to invest or save that money into financial instruments (eg: Fixed deposits, money market funds, unit trust funds, stock market, etc) that can generate returns. If you’re able to find an instrument that’s able to give you higher returns, then your monthly savings/investment into said instrument will be lower. But of course, with high returns, comes with high risk; so be wary of your risk tolerance before putting your money into any financial instrument.

On top of that, if you’re able to fork out a large initial investment, then your monthly savings/investment will also be lowered.

In this case, 5 years is a really short time period to become a millionaire, especially if you’re starting from the ground up. So the next few tables would be a little bit more realistic considering the average Malaysian salary.

How To Be A Millionaire In 10 Years

As you can see here, when your time horizon is longer, you’ll need less monthly savings/investments because you’re making use of the power of compounding. To understand more about how compounding interest works, check out this article.

How To Be A Millionaire In 20 Years

These days, people are always looking for ways to earn fast money. Unfortunately, that usually means you’re either taking on a lot of risk or you’re doing something pretty shady. So, with a 20 years time horizon, you’ll allow your money to grow with a pretty affordable monthly investment/savings plan.

Based on the table above, if you’re earning between RM5,000-7,000, and putting your money into the stock market, you’ll definitely be able to achieve your RM1 million target. It just takes a little more time.

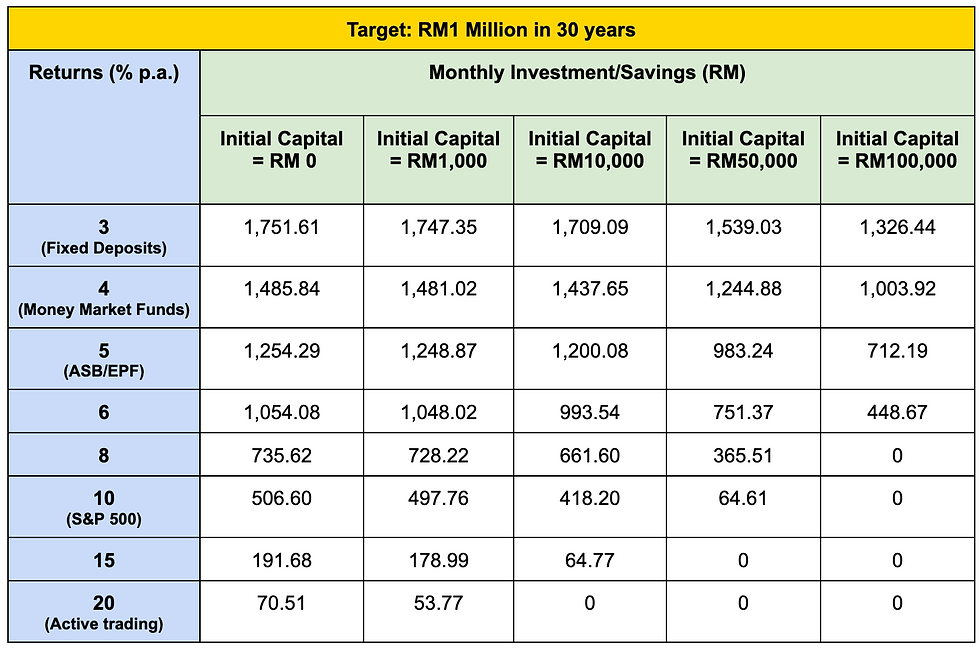

How To Be A Millionaire In 30 Years

Now we’re on to something. If you’re in your late 20s or early 30s, this cheat sheet is definitely realistic and actionable. Even if you have no capital, you’ll only have to set aside roughly RM500-RM1,000 every month into a financial instrument that’ll generate you returns above 5% p.a.

Conclusion

The key to becoming a millionaire is to have a long time horizon and understanding your risk tolerance. Generally, if you’re younger, you’re able to take on more risks with your investments as you’re able to ride out market volatility; which is why it’s always best to start investing early. However, it’s understandable that you may not have that much funds but even with RM100, you can start investing. Find out more about how you can do this here.

We hope this cheat sheet helps and all the best in your financial journey to becoming a millionaire!