Top 5 Cashback Credit Cards in Malaysia 2024

- Mr Money TV

- Oct 11, 2023

- 4 min read

Updated: May 27, 2024

One of the first financial tools most of us will get once we start working is a credit card. And these days we are spoilt for choice with countless credit cards offering numerous benefits and rewards. Among the most popular are cashback credit cards. These cards return a portion of what you spend, directly reducing your monthly bill.

So, here are the top 5 cashback credit cards in Malaysia with a monthly minimum income as low as RM2,000!

P.S. I've also left a little review and pro-tip for each credit card so you'll know exactly what you'll be getting!

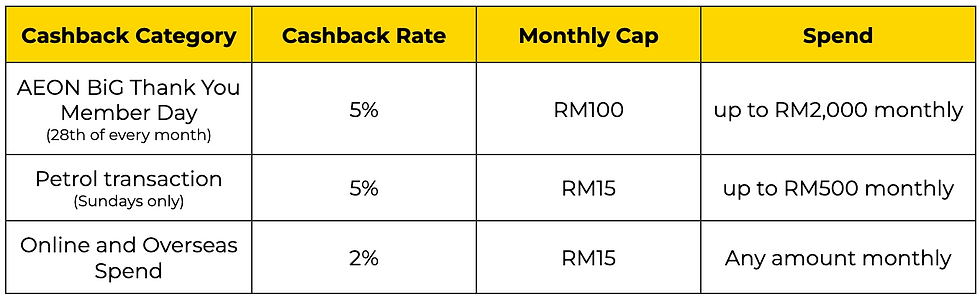

#1 Standard Chartered Simply Cash Credit Card

Features

e-Commerce Purchase Protection up to USD200

Fees and Charges

Eligibility

Minimum Income: RM36,000/year or RM3,000/month

My Review

I think this card is great for big spenders.

With up to RM60 cashback every month, it's one of the highest among this entire list. And not to mention, you can also bypass paying the annual fee when you spend a minimum of RM12,000 a year; so, one big purchase and your annual fee is waived (unlike other cards which may require you to spend every month to have the fees waived).

On that note, just because you get cashback doesn’t mean you should spend excessively. It's a common misconception that more spending means more rewards. But remember, the cashback is only a fraction of what you spend.

So, stick to your budget and spend within your means. The goal is to earn cashback on necessary and planned expenses, not to spend just for the sake of earning rewards.

#2 RHB Cash Back Visa Credit Card

Features

Fees and Charges

Eligibility

Minimum Income: RM24,000/year or RM2,000/month

My Review

To me, this card is quite an all-rounder because regardless of how much you spend and what you spend on, you will still get a percentage of cashback. So, by the end of the month, you can expect to get up to RM10 "deducted" from your overall bill. But of course, the more you spend, the higher the cashback lah.

Here's a pro-tip: To truly benefit from cashback, avoid carrying a balance on your card. This is because interest charges can quickly negate any cashback earned as it keeps compounding with each month your bills go unpaid.

One way you can stay on top of your bills is by setting up automatic payments or reminders to ensure you always pay your bills on time to avoid late fees and interest.

#3 UOB One Card

Features

Fees and Charges

Eligibility

Minimum Income: RM24,000/year or RM2,000/month

My Review

Pretty similar to the RHB Cash Back Visa Credit Card, this UOB card is quite versatile as well. I also heard that it's relatively easy to have your application approved therefore, in a way, this card is "easily accessible".

The only downside would be the annual fee. Unlike most credit cards, this card doesn't waive the first year's annual fee and there are no fee waivers for subsequent years. So, just be ready to fork out RM120 every year lah.

In conjunction with World Financial Planning Month this October, here's a tip to ensure you're getting the most out of your credit card:

Make sure you regularly review and update your card. This is because there are constantly new offers and promotions emerging so you’ll want to review your card's benefits at least once a year to ensure you still have the best card for your spending habits.

#4 AEON BiG Visa Gold Card

Features

Complimentary access to Plaza Premium Lounge (3X per year)

Up to RM200,000 Travel Insurance coverage

Rewards

Fees and Charges

Eligibility

Minimum Income: RM36,000/year or RM3,000/month

My Review

This card is as good as it comes. Not only is the minimum income relatively low but the cashback and additional rewards are quite impressive too!

Issued by the household-named grocery store, AEON, this card offers competitive rewards if you frequently shop there. Not to mention, you can easily get your annual fee waived as it only takes 12 swipes annually (which I’m sure can be achieved if you go grocery shopping at least once a month).

One advice I have for those who have two or more credit cards is to optimize your spending habits according to categories. In other words, use the card that offers the highest cashback in a specific category.

For example, the AEON BiG Visa Gold Card would be a great card for grocery shopping and petrol transactions; whereas the Standard Chartered Simply Cash Credit Card is great for dining out. So, if you were to get both, I would suggest you use them for those respective categories to get the most out of your cashback credit cards.

#5 Alliance Bank Visa Signature Credit Card

Features

Complimentary RM80 e-hailing to Airport (2X per year)

Fees and Charges

Eligibility

Minimum Income: RM48,000/year or RM4,000/month

My Review

The minimum income required for this card is the highest among the rest on this list but the highlight of it is that the cashback rewarded is UNCAPPED! Just by spending as little as RM1 on most transactions, you can already start getting cashback on your overall bill.

But of course, you’ll want to understand the terms and conditions that come with the card. So, whether you’re getting this card or any of the credit cards above, you should do your research and determine if the card you’re getting suits your needs and lifestyle.

Already have a credit card but it’s not a cashback card? Don't worry! You can also take advantage of it by following this comprehensive guide.

Which Cashback Credit Card Is The Best For You in Malaysia?

At the end of the day, it all comes down to your spending habits, lifestyle and personal needs. Maybe an extra incentive when choosing the right card for you is to look out for other benefits like loyalty points, travel benefits, or complimentary insurance.

Personally, I prefer using a cashback credit card in Malaysia because I can reap the benefits “instantly” when my bill is due. In comparison to a rewards credit card, I’ll just be accumulating points and never redeeming them (because I don’t have time to keep up with the rewards being offered).

If you’re still unsure about credit cards, here are some common FAQs that may help you along this journey.

Subscribe to our financial newsletter for the latest news, insights, and advice on personal finance, investing, and more. With every email, you’ll gather the confidence and knowledge to make informed decisions to achieve your financial goals.